Forecast Live utilises Machine Learning (ML) technologies to forecast payments and help Sybiz Vision finance teams, giving them insight and control over cash flow and debtor Management.

Most Sybiz Vision finance teams need automated cash flow forecasting, and automated overdue collections and now it’s possible with Forecast Live.

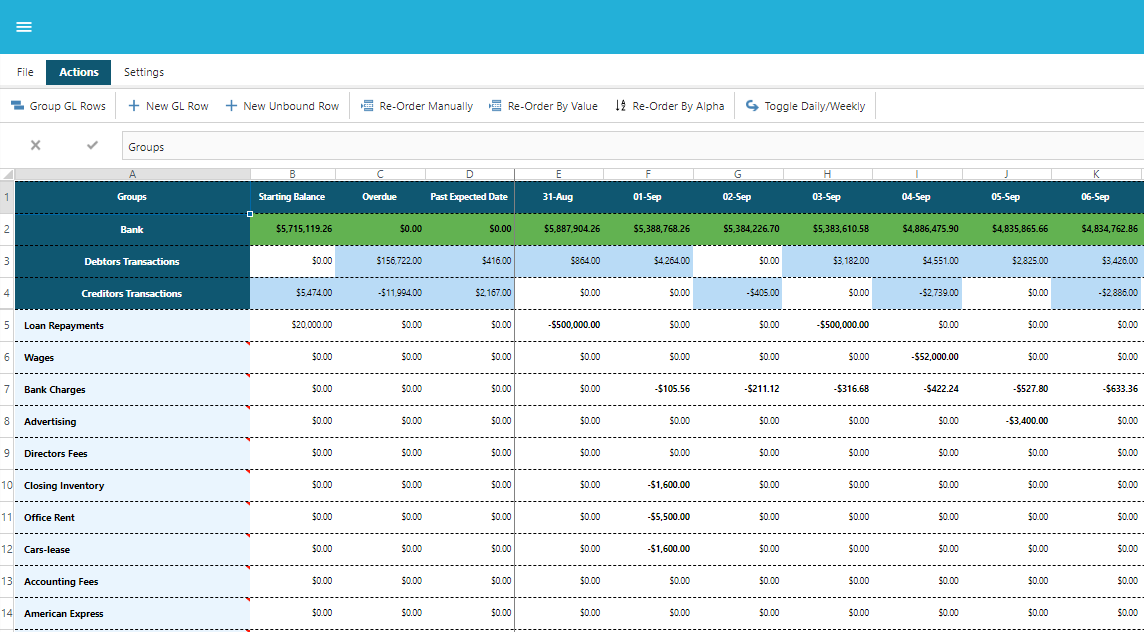

An easy to use Cloud Solution for cash flow forecasting and overdue collections automatically syncs directly with Sybiz Vision, giving a real-time, LIVE picture of overdue debtors / AR and cash flow on a daily, weekly and monthly view.

Forecast Live dynamically builds and maintains your short and long-term Cashflow Forecasts with live data from Sybiz Vision.

This data combines up to date Bank Balances, Debtor & Creditor Information with forward forecasted expenses & cash outflows to accurately predict your cash position. Get instant knowledge of the effects of delayed payments, increased stock holdings and goods supply delays.

Sybiz Vision customers can now use Forecast Live to generate trusted cash flow schedules

Short Term Cashflow forecasting (30 to 180 Days in advance) is a critical challenge for many businesses. Because a more granular approach is needed for this type of forecasting, and your business is constantly trading, it’s near impossible to manually maintain up to date accurate forecasts with live data.

With Forecast Live, we produce automated daily & weekly Cashflow Forecasts to accurately predict your cash position by day or week. Easily move customer & supplier payments along the timeline, plan for additional expenses, or determine when the business will have cash reserves for shareholder drawings or reinvestment.

Forecast Live goes beyond normal forecasting for Sybiz Vision users, identifying customer payment trends and using machine learning to predict when customers will actually pay, often beyond their due date.

Managing and maintaining accurate Financial Year forecasts in today’s business environment and ever-changing economic conditions takes effort. As Actuals become known and Budgets change, it requires significant effort from skilled resources each month to keep up, often performed in complex excel spreadsheets.

We cut time costs and provide automatic forecasts & reforecasts for your financial year end results & cashflow direct from Sybiz Vision. With live data coming directly from Sybiz Vision, always updating the multiple forecasts & cash flow models, it’s easy to plan and make key decisions.

We go beyond average forecasting, identifying customer payment trends using Machine Learning (ML).

Solve your cash flow forecasting problems.

It’s time consuming and difficult to stay on top of outstanding debtors and understanding insights around your customers payment trends. Often you need to manage customers differently, and while you don’t want to lose the personal touch, it’s almost impossible to do this and automate reminders. Until now, until Forecast Live for Sybiz Vision.

Forecast Live helps you improve your cashflow by giving you automated tools and insights that work directly with Sybiz Vision to bring forward customer payments and assist in the collection of overdue accounts.

Copyright © 2019 Plus.Live. All Rights Reserved. | Privacy Policy | Software Licence Agreement | Home